Rethinking Income: A Strategic Adjustment in the FIRE Funds Portfolio

We recently made a subtle but significant shift in the FIRE Funds Income (FIRI) portfolio, a change that speaks volumes about our long-term thinking and analytical discipline

We recently made a subtle but significant shift in the FIRE Funds Income (FIRI) portfolio, a change that speaks volumes about our long-term thinking and analytical discipline. As a result, FIRI’s reported 30-day SEC yield now hovers around 18%, far above the 4–6% target typically sought by FIRE (Financial Independence, Retire Early) investors.

While eye-popping, we don’t view this yield as an anomaly, it’s a reflection of our differentiated strategy. Since launching the FIRE Funds on November 18, 2024, we’ve aimed to challenge conventional wisdom. Rather than clinging to the 60/40 model, FIRI was built to be a diversified income-generating satellite holding, specifically crafted to hedge against structural blind spots that traditional portfolios often ignore.

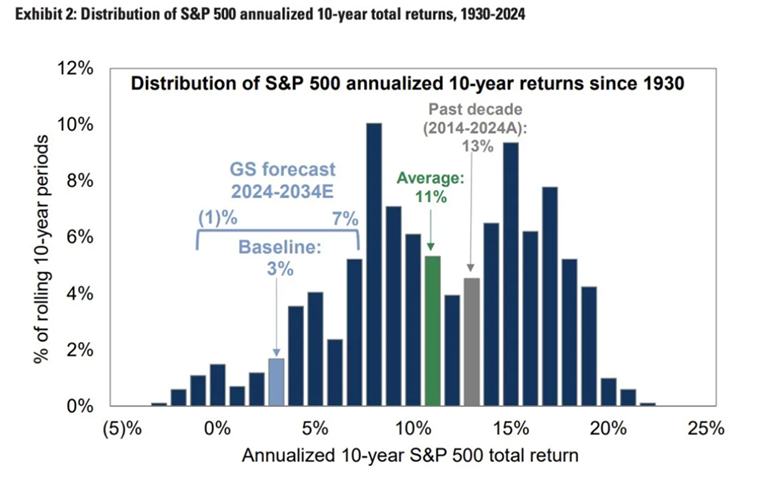

One of those blind spots? Overreliance on historical returns driven by U.S. Treasuries. Investors have become complacent, expecting outsized returns after two consecutive 25% years. But history tells a more sobering story. Just look at the S&P 500’s return distribution since 1930 (as illustrated in the Financial Samurai blog). It includes prolonged periods of stagnation, like the infamous “Lost Decade” from 2000 to 2009. High expectations are fine, but they must be tempered with reality and resilience.

Time for the FIRE Community to Re-Evaluate U.S. Treasury Exposure

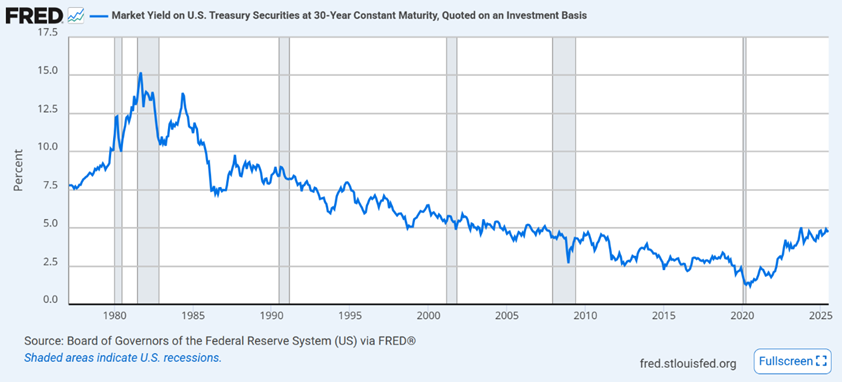

Many in the FIRE community hold onto long-term U.S. Treasury bonds like a warm security blanket. But the world has changed. Treasuries peaked in price around 2020 when yields dropped to 1.2%. Today, they yield about 4.8%, and while that may sound appealing, higher yields don’t mean lower risk. In fact, they often signal the opposite, especially when you factor in inflation and the erosion of purchasing power.

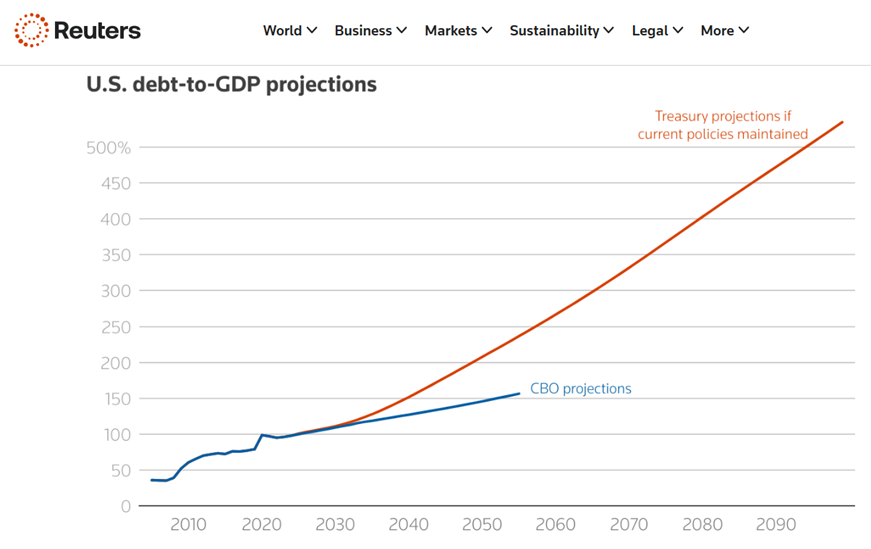

Let’s rewind to 1981, when Treasury yields peaked near 15%. That was a time of 13% inflation. Today’s economic backdrop, marked by ballooning government debt and fiscal strain, bears uncomfortable similarities. Back then, the U.S. was a net creditor. Today, we owe over $36 trillion and counting.

The Bloomberg U.S. Aggregate Bond Index allocates roughly 45% to government debt. That’s a concentration we consider deeply concerning. FIRE is rooted in principles of frugality and long-term planning, so why allocate to the world’s largest debtor? “Risk-free” in default terms doesn’t mean immune from inflation or policy mismanagement. The assumption that U.S. Treasuries will always be a safe haven deserves reconsideration.

With these concerns in mind, we’ve turned our focus to income strategies that offer real-world utility and stronger alignment with FIRE’s values. That search led us to reevaluate where sustainable yield truly lives in today’s market.

Embracing Hard Assets as Income

With that backdrop in mind, we recently made a targeted reallocation: replacing a 3% position in YieldMax XOM Option Income Strategy ETF (XOMO) with YieldMax Target 12 Real Estate Option Income ETF (RTNY). This wasn’t a move made lightly, but one grounded in a desire to realign risk and reward in today’s environment.

XOMO had been attractive due to its energy exposure, strong AA+ credit rating (on par with the U.S. government), and a 25% SEC yield. But we saw a better long-term opportunity in hard assets, especially real estate tied to essential infrastructure.

RTNY, launched in April 2025, focuses on tower and storage real estate companies like American Tower (AMT) and Digital Realty (DLR). These firms benefit from sticky revenues, pricing power, and resilience across economic cycles. Since inception, RTNY has distributed about $0.52, translating to an annualized yield of roughly 13%. While lower than XOMO’s, we view it as a more stable, sustainable income stream. This isn’t just a yield play, it’s a risk-adjusted income evolution.

The move may only affect 3% of the portfolio, but it reflects something larger: our commitment to nimble, intentional portfolio management that adapts to changing macro conditions.

A Call for Evolution in FIRE

We admire the FIRE community’s ethos, its devotion to independence, thrift, and self-reliance. But we believe it’s time to modernize FIRE investing. The old playbook, reliant on U.S. government bonds and blind faith in “safe” assets, may no longer serve FIRE’s goals in a structurally different economy.

Continued investment in Treasuries means backing a government that’s abandoned fiscal discipline. This runs counter to FIRE’s values. We believe FIRE investors deserve, and should demand, better alignment between their capital and their principles.

Our recent pivot to real estate income reflects this evolution. Hard assets backed by essential services offer not just yield, but durability. They reflect a forward-looking approach rooted in financial realism and independence.

We’ll keep making these kinds of updates, small on the surface, but deeply intentional, in pursuit of our mission: helping investors reach FIRE through high-yield, risk-managed strategies that evolve with the times.

Stay tuned.

Risks

Investors should consider the investment objectives, risks, charges, and expenses of the ETF carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.fire-etfs.com or call (855) 514-2777. Please read the prospectus and/or summary prospectus carefully before investing. Investing in securities involves risk and there is no guarantee of principal.

The FIRE ETFs do not invest directly in bitcoin or gold.

ETFs: ETFs that the Fund may invest in are subject to market, economic and business risks that may cause their prices to fluctuate. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying ETFs. Because the Fund invests in ETFs, it is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares.

Asset Allocation Fund of Funds Risk: Asset allocation decisions, techniques, analyses, or models implemented by the Adviser may not produce the expected returns, may cause the Fund’s shares to lose value or may cause the Fund to underperform other funds with similar investment goals. Although the theory behind asset allocation is that diversification among asset classes can help reduce volatility over the long term, the Adviser’s assumptions about asset classes and the Underlying ETFs may diverge from historical performance and assumptions used to develop allocations in light of actual market conditions. There is a risk that you could achieve better returns by investing in an individual fund or funds representing a single broad asset class rather than investing in a fund of funds. The Fund’s performance is also closely related to the Underlying ETFs’ performance and ability to meet their investment goals. Fund shareholders bear indirectly the expenses of the Underlying ETFs in which the Fund invests in addition to the Fund’s management fee so there is a risk of an additional layer or layers of fees. The Fund’s actual asset class allocations may deviate from the intended allocation because an Underlying ETF’s investments can change due to market movements, the Underlying ETF’s investment adviser’s investment decisions or other factors, which could result in the fund’s risk/return target not being met. As a fund of funds, the Fund is exposed to the same risks as the Underlying ETFs in proportion to the Fund’s allocation to those Underlying ETFs.

Aggregated Underlying ETF Risks: The following risks associated with the Underlying ETFs, when combined, are expected to become principal risks at the Fund level due to their significant impact on the Fund’s overall performance, volatility, and ability to achieve its investment objective.

These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice.

* As of 11/30/2024, Mike Venuto manages a total of 236 accounts, including 60 registered investment companies and 176 other accounts. The AUM for the 60 registered investment companies is $8.2 billion, and the AUM for the Other accounts is $43 million.

** As of 11/30/2024, Dan Weiskopf manages a total of 33 accounts, including 5 registered investment companies and 28 other accounts. The AUM for the 5 registered investment companies is $1.2 billion, and the AUM for the Other accounts is $14 million.

Distributed by Foreside Fund Services, LLC. Foreside is not related to Investment Adviser, Tidal Investments, LLC.