My Son is Living with Me and I Couldn’t Be Happier

My son decided to move back home to save money as he transitions from college to the real world, and my wife and I couldn’t be more thrilled. As parents, we’re excited to have more family time, but this time, he’s an adult, and the atmosphere will require a balance of mutual respect. While his primary reason for moving back is financial, his goal remains financial independence, though starting salaries may not fully cover living expenses.

It seems he thinks his parents would make better roommates than strangers, and we are incredibly proud of the man he has become. However, we need to set realistic expectations and fair financial boundaries. Living at home won’t be a free ride and the rules will reflect this new stage of life. Chores will be fairly divided among the three of us, reinforcing the importance of shared responsibility beyond financial contributions. And one key rule: No doting or hovering by Mom!

The Reality of Living Costs

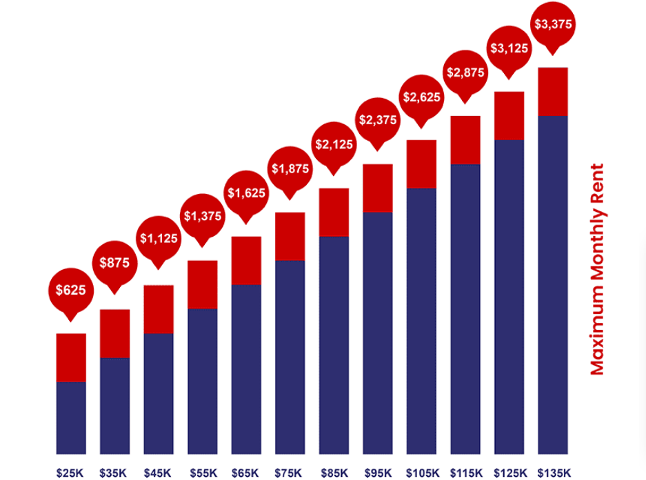

It is estimated by the American Apartment Owners Association that rent is usually about 30% of a person’s salary. In New York City, where we live, this amount is probably higher and part of the reason why so many in this city feel poor. Budgeting in an expensive city has its challenges and is probably why very few in the FIRE community live in expensive cities (see Justin Graiber’s article, Popular Budgeting Strategies Used By FIRE). Of course, paying no rent simply isn’t the reality of life. Housing is the major portion of the 50% that is referred to as “needs” in the 50/30/20 budgeting strategy.

Strategy for Independence

As good parents, we want the best for our children. This includes teaching them to live within their means, save for the future and find enjoyment in a lifestyle that prioritizes joy over monetary pleasure. While our children may wish they were trust fund babies, we believe that is not a healthy path to financial independence and discipline.

To create the budget, we assume he will start with a salary between $45,000 and $55,000 a year. In New York City, that $50,000 nets him about $39,369 yearly, or about $3,281 per month after tax (kind of depressing for my son!). Worse still, he will also need a deposit for the apartment, likely around $1,500-$2,500. While he is living with us, we will require him to deposit 30% of his net cash flow in a bank account each month. Some of this money will help with the deposit and some may provide him with future sanity, or even a leg up with a retirement account.

Netting $2,165 for discretionary spending, which includes food, fun and transportation, is not a lot of money. We are also going to suggest that he start a separate account called FIRE to put aside 10% of his net income (about $320). We will not check on this savings program and, while it is lower than what is typically recommended in the FIRE community, it is a realistic amount. We don’t want him to feel like a mooch and in NYC, eating out or delivery costs between $25 and $50. Good news, when he eats at home, Mom and I will get to order for him and eat with him (if he wants to eat alone in his room, he must pay).

He must budget $500 to $800 a month for food, with a similar amount for travel and discretionary spending (clothes and haircuts). He has a car, which we will park for free outside of New York City. Selling the Subaru doesn’t make sense since he may end up moving. Budgeting to save for financial independence while balancing the high cost of living in New York highlights that structure matters when setting FIRE goals. Ultimately, it’s the FIRE lifestyle that we are trying to impress upon him.

To help him get started, we are planning a regular 15-minute mutual FIRE catch-up on Sundays at whatever time he chooses. Keeping financial conversations separate from dinner will make things feel more normal. Money discussions always have friction, so setting a time limit ensures everyone knows when they will end. By having these talks in a professional and structured manner, we hope to avoid any feelings of indebtedness, judgment or resentment. It’s all about boundaries and setting up a realistic plan, which will take time and patience on everyone’s part.

Savings Discipline & Economic Realities:

As a rule, everyone should save and maximize capital throughout economic cycles to secure their future. Young adults seeking financial independence benefit from starting early and leveraging the power of compounding, a key focus of the FIRE community. However, many in Generation Z (1997-2012) have never experienced a severe economic downturn, making it difficult to grasp the reality of a lost decade or a 30% market correction. Diversification and investing in non-correlated assets often seem unnecessary when personal experience suggests that 25-30% annual returns are the norm.

According to ChatGPT, the S&P 500 compounded at an extraordinary 27.7% rate over the past three years. In 2022, the index declined 18%, but in the previous two years, it surged 26.29% and 25.02% with dividends. For investors accustomed to these gains, it’s easy to assume such growth is sustainable, yet history suggests otherwise.

According to Harry Browne’s classic book “The Permanent Portfolio”, economic cycles are a natural and ongoing phenomenon. However, two real-life challenges make navigating these cycles difficult:

- People avoid saving during a recession due to fear of the future, even though downturns are often followed by prosperity. Buying low provides greater value.

- Economic cycles are difficult to predict, despite media and political headlines. By definition, a recession is two consecutive quarters of GDP decline, making its impact hard to assess until the conditions are evident.

Mr. Browne created the Permanent Portfolio with four equal investment buckets, each designed to perform well under different economic conditions. The goal is to reduce the dramatic drawdowns from changing economic cycles better than the modern portfolio theory that drives the 60/40 model.

Again, the experience for most people these past few years has been that of economic prosperity. The lost decade (2001–2009) is something few want to recall. Sure, inflation has hurt people of late, but that is more controllable when it has only lasted for a short period of time. But deflation, marked by falling prices and contracting economic conditions, poses a greater long-term risk. Historical examples include the Great Depression (1929–1933) and the 1999–2009 recession. While market crashes seem manageable in hindsight, the months following them were deeply concerning for those who did not have savings. For those who had a safety net, post-crash conditions were posted as investment opportunities!

Incorporating the Permanent Portfolio as part of a FIRE strategy can further enhance portfolio resilience. Smart stock selection, combined with ETFs launched on the Tidal platform, can help with this. There is no secret that investing is about discipline, budgeting, risk and following a methodology.

About the author: Dan Weiskopf

Dan Weiskopf is the senior portfolio manager at Tidal Financial Group. He is co-portfolio manager for a number of ETFs, including the Amplify Transformational Data Sharing ETF (BLOK), Fire Movement ETFs (FIRI and FIRS), and the two Unusual Whales Subversive Democratic and Republican Trading ETFs (NANC & KRUZ). For more information, readers can reach out to Dan at https://www.linkedin.com/in/dan-weiskopf-45886111/

To learn more about Tidal’s FIRE ETFs, visit www.fire-etfs.com. For those who want to learn more about the Permanent Portfolio or get a copy of the book, please email Dan Weiskopf [email protected].

Investors should consider the investment objectives, risks, charges, and expenses of the ETF carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.fire-etfs.com or call (855) 514-2777. Please read the prospectus and/or summary prospectus carefully before investing. Investing in securities involves risk and there is no guarantee of principal.

Shares of the ETF may be bought or sold throughout the day at their market price on the exchange on which they are listed. The market price of an ETF’s shares may be at, above or below the ETF’s net asset value (“NAV”) and will fluctuate with changes in the NAV as well as supply and demand in the market for the shares. Shares of the ETF may only be redeemed directly with the ETF at NAV by Authorized Participants, in very large creation units. There can be no guarantee that an active trading market for the Fund’s shares will develop or be maintained, or that their listing will continue or remain unchanged. Buying or selling the Fund’s shares on an exchange may require the payment of brokerage commissions and frequent trading may incur brokerage costs that detract significantly from investment returns.

ETFs: ETFs that the Fund may invest in are subject to market, economic and business risks that may cause their prices to fluctuate. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying ETFs. Because the Fund invests in ETFs, it is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (”NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares.

AUM: Assets under management (AUM) is the market value of the investments managed by a person or entity on behalf of clients. AUM is used in conjunction with management performance and management experience when evaluating a company.

SMA: A separately managed account (SMA) is a portfolio of securities that is managed by a professional investment firm for a single investor. SMAs are designed to be customized to meet the specific needs of the investor, and can include stocks, bonds, and other securities.

Inflation Risk: Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the present value of the Fund’s assets and distributions, if any, may decline.

Market Risk: The market value of the portfolio’s holdings rise and fall from day to day, so investments may lose value.

New Fund Risk: The Fund is a recently organized management investment company with no operating history. As a result, prospective investors do not have a track record or history on which to base their investment decisions.

Non-Diversification Risk: As a non-diversified fund, the Fund may invest a larger portion of its assets in the securities of one or a few issuers than a diversified fund. A non-diversified fund’s investment in fewer issuers may result in the fund’s shares being more sensitive to the economic results of those issuers. An investment in the Fund could fluctuate in value more than an investment in a diversified fund.

* As of 11/30/2024, Mike Venuto manages a total of 236 accounts, including 60 registered investment companies and 176 other accounts. The AUM for the 60 registered investment companies is $8.2 billion, and the AUM for the Other accounts is $43 million.

** As of 11/30/2024, Dan Weiskopf manages a total of 33 accounts, including 5 registered investment companies and 28 other accounts. The AUM for the 5 registered investment companies is $1.2 billion, and the AUM for the Other accounts is $14 million.

Distributed by Foreside Fund Services, LLC. Foreside is not related to Investment Adviser, Tidal Investments, LLC.