Avoiding FIRE Could Affect Your Glide Path

As retirement planning becomes more and more essential in a world of increasing life expectancies and evolving market dynamics, glide path funds, with about $3.5 trillion in assets under management (AUM) have gained popularity as a convenient, constructed solution for long-term investors.

These funds, commonly implemented through target-date funds, are designed to automatically adjust the asset allocation of a portfolio over time based upon a traditional form of managing risk by shifting away from equities and into bonds.<br>

However, is past performance the only way to manage risk, especially when macro-economic conditions have changed so dramatically over the decades?

In this article, we explore what glide path funds are, how they work, and why we believe alternatives strategies should be a greater part of a retirement portfolio.

What are Glide Path Funds?

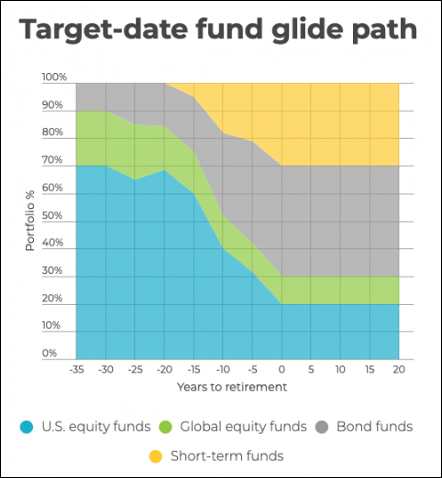

A glide path is an investment framework that adjusts a portfolio’s asset allocation gradually over time, typically shifting from higher-risk, higher-return assets (like equities) to more conservative assets (like bonds and cash equivalents) as the investor approaches a target date, often retirement.

These strategies are most commonly embedded in target-date funds (TDFs), where the “target date” is usually the expected retirement year of the investor.

For example, a 2045 TDF is designed for someone planning to retire around 2045.

The glide path dictates how the asset mix evolves between the present date and the target date.

Those in their 20s in the FIRE community have such a goal, and even if it sounds like a long way off, trust me, it will creep up on you.

But to be clear, for those hoping to glide through to a 2025 retirement, this does not mean that no risk exists in that 2025 target date fund, especially when bonds seem as volatile as equities.

The goal of such a dated portfolio is to use past statistics to manage volatility so that the draw down and upside capture1 is balanced to be shallower based upon historic inputs.

The problem is that past performance truly may not be aligned with future results since macro-economics are so different today than what they were 10, 20, or even 50 years ago.

How Glide Paths Work

- Accumulation Phase (Far from Retirement)

In the early years, the fund allocates a higher percentage of assets to equities. This is to maximize growth potential during the accumulation phase, taking advantage of the investor’s long-term horizon to ride out market volatility.

- Transition Phase (Approaching Retirement)

As the target date approaches—usually starting around 10–15 years before retirement—the fund begins to shift toward a more balanced allocation, introducing more fixed income and reducing equity exposure. This attempts to lower risk while still allowing for moderate growth.

- Decumulation Phase (Post-Retirement)

Some glide paths continue to adjust even after the target date, becoming increasingly conservative to preserve capital and provide income. Others “lock in” at the target date, maintaining a fixed allocation going forward.

“To” vs. “Through” Glide Paths

Glide paths can be categorized into two main types:

- “To” Glide Paths: These funds reach their most conservative allocation at the retirement date and then stop adjusting. They assume the investor will move assets elsewhere after retiring.

- “Through” Glide Paths: These continue to evolve even after the retirement date, assuming the investor will stay in the fund for years post-retirement.

Each approach has its own philosophy and implications for risk and income planning.

Benefits of Glide Path Funds

- Automation & Simplicity: Investors don’t need to manually rebalance or adjust portfolios as they age.

- Diversification: These funds offer broad diversification across asset classes and sometimes even geographies and sectors.

- Behavioral Discipline: Reduces the temptation for emotional market timing by sticking to a predefined path.

- Suitability for 401(k) Plans: Many employers offer TDFs as the default investment in retirement plans due to their hands-off nature.

Potential Drawbacks

- One-Size-Fits-All Approach: Glide paths are based on general assumptions about risk tolerance and time horizon that may not match every investor.

- Historic Data Dependence – The future outcome for investor success should not be dependent upon historic data when it is almost a guarantee that macro-economics are different today than what they were 20, 30, or 50 years ago.

- Lack of Flexibility: Investors with unique financial goals or changing life circumstances may need more customized strategies.

- Performance Variability: Different fund managers use different glide paths, leading to performance and risk differences even among funds with the same target year.

Custom Glide Paths and Institutional Grade Solutions

Some institutions and advisors create custom glide paths, tailoring asset allocation to specific employee demographics, retirement plan structures, or risk preferences. These can offer better outcomes but require more resources and expertise to manage effectively. In this context, the FIRE ETFs were designed to augment the glide path solutions with additional diversification and best-of-breed portfolio managers on the Tidal platform. Diversification2 comes in the form of more exposure to gold, bitcoin, and options strategies.

We would also argue that many investors who subscribe to the FIRE movement should welcome the opportunity to pursue more alternatives and somewhat sophisticated strategies. In a world where global capital markets are driven by geo-political activity and disputes, we think alternative funds that are less correlated to market sentiment, consumer confidence, and valuation concern is a means of true diversification.

This is why Harry Brown’s perspective of the Permanent Portfolio is so important. By dividing a portfolio into 4 economic regimes, the thesis presumes an approach that humbly addresses the true reality of risk and return. No one knows when you are in the “middle of the forest” or how long the economic cycle will last until after the statistics form the trend.

When the economists call for a recession, it is all about the rear-view mirror, and price multiples may be crushed. Similarly, when the period of prosperity is coming, you want to be a buyer when multiples are low. However, during the economic period where headwinds are challenging, it is hard to step up and be that optimistic person. We are, of course, all for the long-term approach to the dollar cost averaging approach that FIRE culture focuses on.

However, our thought is that alternatives create that bucket which compliments the broader approach of glide path funds, target date funds, and the 60/40 model in general. Having a robust diversified approach that balances a long-term strategy could arguably help some of the zigging and zagging.

The Alternatives Bucket:

The FIRE ETFs are designed to provide an institutional grade solution customized for the FIRE community. Following the Harry Brown Permanent Portfolio thesis, the FIRE Wealth Builder ETF (FIRS) systematically rebalances across 4 different economic regimes with the belief that markets efficiently follow the different economic cycles. Together with the FIRE Funds Income Targeted ETF (FIRI), these two funds can be matched as alternatives since their investment approach is different than the glide path assumptions associated with traditional glide path target date portfolios. Income is generated through options and exposure to commodities such as gold and bitcoin. For more on this, see “My Son Is Living With Me and I Couldn’t Be Happier.”

Final Thoughts

Glide path funds provide a well-structured, disciplined investment approach that adapts to an investor’s stage in life.

While not without limitations, they remain a powerful tool for retirement savers, especially those who prefer a “set-it-and-forget-it” strategy.

Understanding how they work and choosing between “to” and “through” models, can help investors align their retirement portfolios with long-term financial goals.

Most importantly, by providing a 20% allocation to an alternatives bucket to complement these strategies, like the FIRE ETFs, investors can try to answer the concerning questions: is this time different?

Why follow past statistics when we truly might be in uncharted waters?

Upside Capture1: Upside capture refers to the extent to which a portfolio or fund participates in market gains during periods when the benchmark index is rising. An upside-capture ratio above 100% indicates that the investment has outperformed the benchmark in up markets, while a ratio below 100% indicates underperformance. This metric is typically used to assess how well a strategy performs relative to a benchmark during positive market conditions and does not guarantee future results

Diversification2: Diversification neither assures a profit nor guarantees against loss in a declining market.

Risks

Investors should consider the investment objectives, risks, charges, and expenses of the ETF carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.fire-etfs.com or call (855) 514-2777. Please read the prospectus and/or summary prospectus carefully before investing. Investing in securities involves risk and there is no guarantee of principal.

The FIRE ETFs do not invest directly in bitcoin or gold.

ETFs: ETFs that the Fund may invest in are subject to market, economic and business risks that may cause their prices to fluctuate. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying ETFs. Because the Fund invests in ETFs, it is subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value (“NAV”), an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares.

Asset Allocation Fund of Funds Risk: Asset allocation decisions, techniques, analyses, or models implemented by the Adviser may not produce the expected returns, may cause the Fund’s shares to lose value or may cause the Fund to underperform other funds with similar investment goals. Although the theory behind asset allocation is that diversification among asset classes can help reduce volatility over the long term, the Adviser’s assumptions about asset classes and the Underlying ETFs may diverge from historical performance and assumptions used to develop allocations in light of actual market conditions. There is a risk that you could achieve better returns by investing in an individual fund or funds representing a single broad asset class rather than investing in a fund of funds. The Fund’s performance is also closely related to the Underlying ETFs’ performance and ability to meet their investment goals. Fund shareholders bear indirectly the expenses of the Underlying ETFs in which the Fund invests in addition to the Fund’s management fee so there is a risk of an additional layer or layers of fees. The Fund’s actual asset class allocations may deviate from the intended allocation because an Underlying ETF’s investments can change due to market movements, the Underlying ETF’s investment adviser’s investment decisions or other factors, which could result in the fund’s risk/return target not being met. As a fund of funds, the Fund is exposed to the same risks as the Underlying ETFs in proportion to the Fund’s allocation to those Underlying ETFs.

Aggregated Underlying ETF Risks: The following risks associated with the Underlying ETFs, when combined, are expected to become principal risks at the Fund level due to their significant impact on the Fund’s overall performance, volatility, and ability to achieve its investment objective.

These opinions are not intended to be a forecast of future events, a guarantee of results, or investment advice.

* As of 11/30/2024, Mike Venuto manages a total of 236 accounts, including 60 registered investment companies and 176 other accounts. The AUM for the 60 registered investment companies is $8.2 billion, and the AUM for the Other accounts is $43 million.

** As of 11/30/2024, Dan Weiskopf manages a total of 33 accounts, including 5 registered investment companies and 28 other accounts. The AUM for the 5 registered investment companies is $1.2 billion, and the AUM for the Other accounts is $14 million.

Distributed by Foreside Fund Services, LLC. Foreside is not related to Investment Adviser, Tidal Investments, LLC.